fanduel 1099|Fantasy Football, Fantasy Baseball, Fantasy Basketball and : Manila FanDuel must report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a specific set of criteria. This criteria varies by product. As such, you will not . Collection Video Dragk Collection [2022-07-14] [Dragk] Thread starter Hentagram; . F95zone is an adult community where you can find tons of great adult games and comics, make new friends, participate in active discussions and more! Quick Navigation. Members. Forum Rules.

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs

PH2 · Taxes with FanDuel Sportsbook

PH3 · Taxes with FanDuel Casino

PH4 · Taxes

PH5 · Tax Considerations for Fantasy Sports Fans

PH6 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH7 · Sports Betting Taxes: How They Work, What's

PH8 · How Are Gambling Winnings Taxed?

PH9 · Frequently Asked Questions

PH10 · Fantasy Football, Fantasy Baseball, Fantasy Basketball and

Introduction. Aneska gained notoriety after her appearance on the Dr. Phil show, where her extreme behavior shocked audiences worldwide. This article delves into Aneska’s background, her behavior on Dr. Phil, the aftermath of her appearance, updates on her life, psychological insights into her behavior, impact on her family, lessons .

fanduel 1099*******Tax Forms for a particular Tax year will be available for download on or after January 31st of the year after the calendar year in question. For example, 2023 Tax Forms will be available by January 31, 2024. All Tax Forms are available for PDF’s download following this link.Select the Tax Form name . Tingnan ang higit paFanDuel is legally prohibited from providing tax advice and unfortunately cannot answer this question. Instead, we highly suggest you reach out to a professional . Tingnan ang higit pa

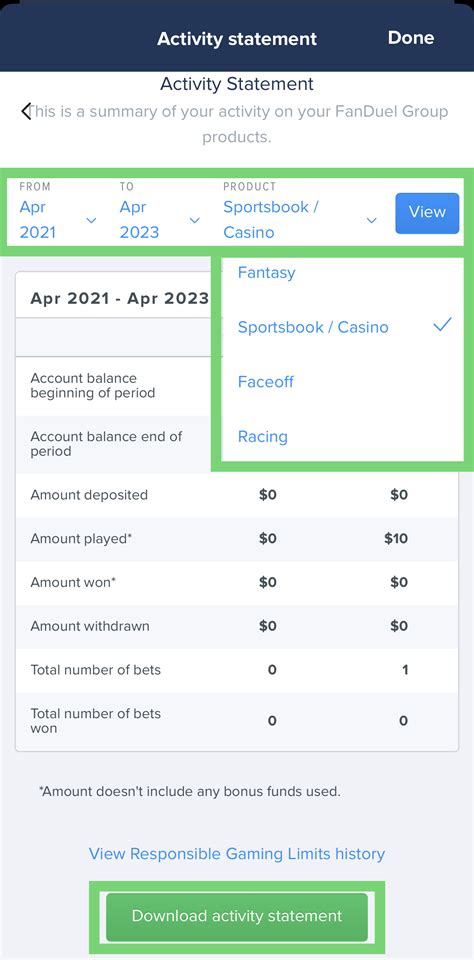

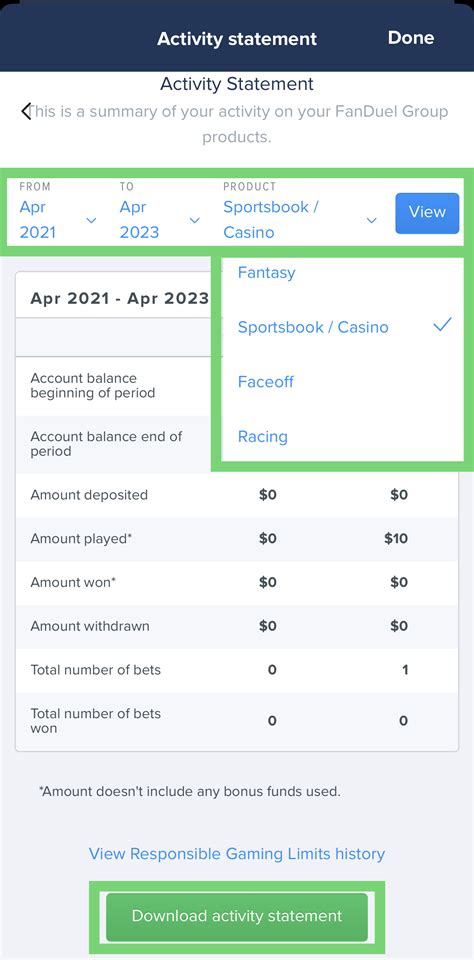

Some Tax Forms from previous calendar years are available following this link.All you need to do is click the applicable FanDuel products that you play on, select the . Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement. Tingnan ang higit paFanDuel must report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a specific set of criteria. This criteria varies by product. As such, you will not .

Ago 2, 2024 — Learn how to handle taxes on your sports betting income, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how to deduct your .

Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a formula to .Ene 31, 2024 — For federal taxes, there are two types of withholdings on gambling winnings: a regular gambling withholding (24% or 31.58% for certain non cash payments) and back .Peb 24, 2024 — As a professional player, you might receive a Form 1099-MISC or a Form W-2G from Fanduel. Form 1099-MISC is used to report miscellaneous income, such as rents, .FanDuel is the leader in one-day fantasy sports for money with immediate cash payouts, no commitment and leagues from $1.

Mar 21, 2024 — Even FanDuel, one of the country's leading online sports betting platforms, doesn't hazard a guess about how states or municipalities will handle gambling proceeds.

FanDuel must report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a specific set of criteria. This criteria varies by product. As such, you will not .fanduel 1099 Fantasy Football, Fantasy Baseball, Fantasy Basketball andFanDuel is required to report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a very specific set of criteria. This criteria varies by product. As .Peb 24, 2024 — Explore the complexities of tax regulation compliance for Fanduel players in this comprehensive guide. Discover the significance of documenting both cash and non-cash prizes and learn about crucial IRS forms like 1099-MISC and W-2G. Delve into professional insights on the importance of meticulous financial record-keeping and seeking expert tax advice.

fanduel 1099FanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: Winnings (reduced by wager) are $600.00 or more; and . Form 1099 - The net aggregate winnings for the tax year above $600 Reply replyWARNING TO ALL OF YOU* The winnings go towards your gross income.That's how I got fucked. And now I owe irs 12800. Bet mgm said I won 46k but I ACTUALLY lost 11k on the year. Still my earned income went up by 46k!!If you take home a net profit exceeding $600 for the year playing on websites such as DraftKings and FanDuel, the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

FanDuel is required to report certain wagering transactions to the IRS on Form W-2G(s), but only when a transaction meets a very specific set of criteria. This criteria varies by product. As such, you will not receive any variation of a Form 1099 (e.g., Form 1099-MISC, Form 1099-K, etc.) from FanDuel summarizing your annual wagering activity.Nob 17, 2023 — However, depending on the how your winnings are classified with the payer, you may receive Form 1099-MISC. You can report winnings from a 1099-MISC as “Other Income” on your tax return. If your winnings are paid using a third-party platform like Venmo or PayPal, you may receive winnings reported on Form 1099-K.FanDuel is committed to providing a fair and transparent ecosystem for all users. It’s our job to ensure that our players can be confident in the integrity of every game, every day. 1. The Rules. . including 1099-MISC reporting forms. Visit our Terms for more information. 6. Account Management, Security and Protection

Taxes On Gambling Winnings FanDuel | FanDuel Tax Info | FanDuel Sportsbook 1099 | FanDuel Withdrawal Taxes | Fanduel 1099 Gambler Tax Return Preparation To understand the treatment of gambler taxation, you must know TWELVE BASIC .

May 31, 2019 — I received a 1099-Misc of $5,661 from FanDuel and have filed that on my tax return. On Draftkings, I had a yearly loss of $1,300. Can I offset these fantasy sports sites? You can if you itemized deductions. If you take the standard deduction, you cannot offset any of .New FanDuel customers Bet $20, GET $150 in Bonus Bets if your Moneyline Bet Wins or a $500 bonus on fantasy with their first deposit. FanDuel offers daily fantasy contests for cash prizes & legal wagering on sports betting markets for all major sports.

If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax forms no later than January 31, 2024. Learn more about what is reportable to the IRS: Fantasy Sports; Sportsbook and Casino

Should you win, those paying you are required to issue you a Form W2-G titled Certain Gambling Winnings — similar to Form 1099, it is a record of your winnings.

Mar 11, 2024 — Even if you don't receive a 1099 form, you are still required to report all of your income on your federal and state income tax returns. The IRS planned to implement changes to the 1099-K .

FanDuel may be required to report your activity on our Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules. As it presently stands, FanDuel only reports activity on our Daily Fantasy Sports/Faceoff product that results in an annual aggregate profit of .

Ene 18, 2023 — Do You Have to Pay Taxes on DraftKings, FanDuel, BetMGM, and Other Fantasy Sports Bets? . a Form 1099-MISC. In some cases, they will send a W-2G instead. How Do Fantasy Sports Sites and Apps Determine Who to Send Form 1099-MISC? Fantasy sports sites calculate a player’s net profits to determine the players who get the 1099 forms.

PSA - several people on RG mentioned that the Fanduel 1099-MISC notification emails ended up in spam folders, so if you play on FD you might want to check to be sure you didn't miss it. Reply replyHul 7, 2021 — Typically, you’ll receive a Form 1099-MISC or a 1099-K for payment from a third party source like PayPal or Venmo. Of course, the same information is sent to the IRS. This is where many Fantasy .Receive a 1099-MISC from FanDuel or DraftKings? Got questions about Fantasy Sports, Sports Betting, Gambling and Cryptocurrency Taxes? Then you came to the right place! We’re focused on providing unparalleled, valued added tax and consulting services to the casual and professional Fantasy Sports Player, Sports Bettor, Gambler and .

Bitte geben Sie dazu die ersten 16 Ziffern Ihrer Quittungsnummer bzw. Spielauftragsnummer ein. Das Ergebnis wird Ihnen sofort angezeigt. Spielauftragsnummer / Quittungsnummer. . Installieren Sie unsere App und nutzen Sie lotto-rlp.de auch offline, indem Sie die Seite zum Home-Bildschirm Ihres Smartphones hinzufügen und .

fanduel 1099|Fantasy Football, Fantasy Baseball, Fantasy Basketball and